- Social Leverage Weekly

- Posts

- Social Leverage Letter | Issue #59

Social Leverage Letter | Issue #59

Valuation Compression in Software, Higher Valuations in AI, Labor Hoarding, and Building Enduring Media Companies

A weekly newsletter for early-stage seed startups and investors.

Was this email forwarded to you? Sign up here.

READING

How Low Could Valuations Go?

On the public side, software valuations continue to compress. Multiples are now below 2016 levels. With the Fed hell-bent on raising rates, how low will forward multiples fall?

High Valuations for Early Stage Deals

Despite the fear, uncertainty and doubt, investors are funneling their energy and money into early stage AI. Competition is keeping prices high.

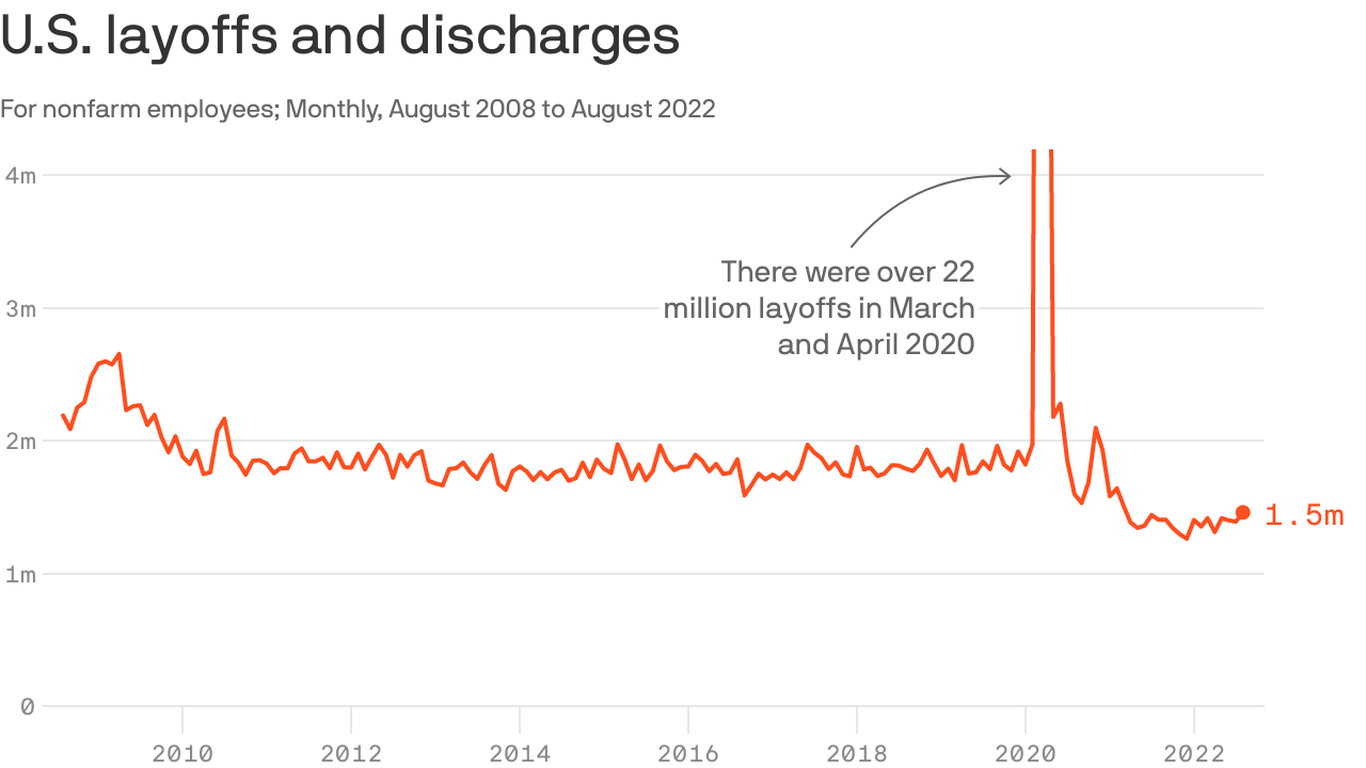

Labor Hoarding

We've heard a lot about 'quiet quitting' over the past few months. Now, 'labor hoarding' is creeping back into the lexicon. What is it, what does it mean for the economy going forward, and for startups in particular?

LISTENING

Panic with Friends

Dave Finocchio and Howard have a wide-ranging conversation on what it was like to found the Bleacher Report (acquired for +200M), and Dave’s latest attempt at building a mainstream climate brand.

Infinite Loops

David Senra is the creator of the Founders podcast. In this episode he talks about his success studying entrepreneurs throughout history, and the common themes he’s discovered that can provide insights for today’s budding founders.

DEAL SPOTLIGHT

Highlighting interesting seed rounds from around the globe:

Fintech Startup Arch Raises Oversubscribed $5M Seed Round, Aims to Become “the Blackrock of Web3”

Decentralized finance (DeFi) asset manager Arch announced the closing of an oversubscribed $5 million seed round. DCG and Upload Ventures led the round, with participation from Soma Capital, GBV, Devlabs, Ripio Ventures, Platanus Ventures, and other notable angel investors.

Arch’s platform provides investors passive exposure to digital assets by buying a basket of crypto assets through a single token, much like buying an ETF in traditional finance.

"Arch develops tokenized index-products, which dramatically simplify how people can build and manage a well-diversified crypto portfolio, saving time and energy," said Arch CEO Christopher Storaker.

Users interact with smart contracts to buy tokens that track indexes constructed by the firm’s research arm, Arch Intelligence. Their proprietary Arch Token Classification Standard (ATCS) that tracks more than 1,000 classified tokens is an industry first, according to a company release.

The company is building passive investment vehicles using web3 principles: the platform is permissionless, does not provide individualized advice, and its tokens are self-custodied.

WEB3 ROUNDUP

News on Crypto/web3:

Social tokens will be the engine of Web3 from fanbases to incentivization

3 Cryptocurrencies That Will Explode as Web3 Expands

Google and Coinbase partner up to expand Web3 ecosystem

Blockchain Bridges Keep Getting Attacked. Here's How to Prevent It

6 tips for launching a blockchain startup

JOB BOARD

Explore openings at our portfolio companies:

Featured Jobs:

Check out all of our portfolio companies at Social Leverage.

© 2017-2021 All Rights Reserved, Social Leverage LLC.

Affiliate Disclosure: Social Leverage Group, LLC ("SLG"), Social Leverage Capital Fund I, LP ("SLC"), Social Leverage Capital Fund II, LP ("SLCII"), Social Leverage Capital Fund III, LP ("SLCIII") and Social Leverage Capital Fund IV, LP ("SLCIV") are all distinct entities from Social Leverage, LLC ("SL"). Social Leverage is not a registered investment advisor. SLC, SLCII, SLCIII, SLCIV, SLG and SL have used the logo and branding of Social Leverage with the permission of Social Leverage Group, LLC.