- Social Leverage Weekly

- Posts

- Social Leverage Letter | Issue #56

Social Leverage Letter | Issue #56

A Mountain of Dry Power, Talent Tech Hubs, Overcoming Procrastination, and the Next Steps After Raising Your First Million

A weekly newsletter for early-stage seed startups and investors.

Was this email forwarded to you? Sign up here.

UPFRONT

$290B in VC Dry-Powder at the Ready

It’s estimated there’s $290B in dry-powder with U.S. venture capitalists, and Decibel Partners founder Jon Sakoda says firms will start deploying those funds next year at a pace that could match 2021. He’s also forecasting dry-powder reserves will peak at $300B in 2024.

READING

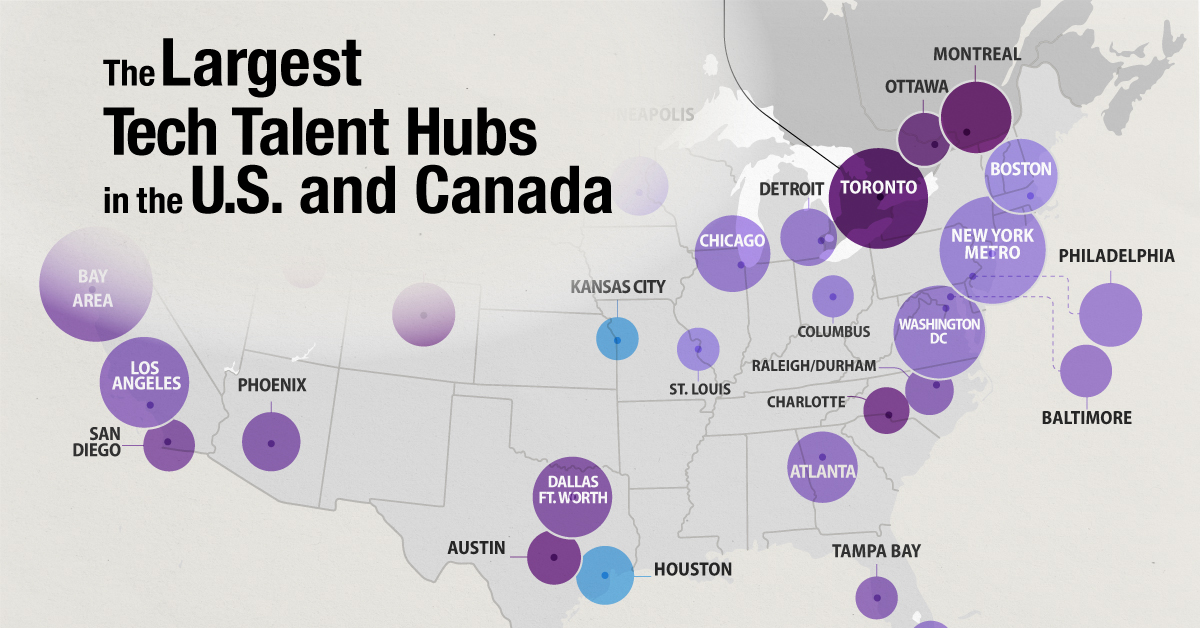

The Biggest Tech Talent Hubs in the U.S. and Canada

The tech workforce just keeps growing. In fact, there are now an estimated 6.5 million tech workers between the U.S. and Canada — 5.5 million of which work in the United States. Silicon Valley remains the most dominant tech hub, with a talent pool of nearly 380,000 tech workers. Tech giants continue to grow their presence in Canada, making it the next big destination for tech talent. Post-COVID has seen remote work as here to stay, yet there isn’t a mass exodus of tech talent from the traditional coastal hubs.

Embrace the 30-for-30 Plan to Overcome Procrastination

With a little science, and a little emotional intelligence, you can make a whole lot of progress towards a goal you've been putting off. 30-for-30 overcomes your limbic system’s focus on the short term and allows your neocortex to bring your long-term vision to the forefront.

LISTENING

A lot to learn in this episode – from the original insight that let to FIGS’ founding, the basic financial profile of an apparel retailing, and the biggest lessons for those building product-centric businesses.

WATCHING

So Your Startup Raised $1 Million. Now What?

We hear about startups raising millions of dollars all the time now – but what should founders actually do the day the check hits? Find out why in this freshly branded version of Office Hours with the legendary Garry Tan.

DEAL SPOTLIGHT

Highlighting interesting startups from around the globe:

Atlanta-based Any Distance Raises $1.5M Pre-Seed to Build Social Activity Tracking App

Atlanta-based Any Distance announced a $1.5M pre-seed round. The company’s new activity tracking platform for iPhone and Apple Watch gamifies getting people to be active.

The app offers a privacy-first way for users to share their active life while earning unique AR collectibles. The company is reimagining activity tracking by creating a lifestyle brand that prioritizes inclusivity, privacy, and safety — while at the same time harnessing “gamification” to inspire community.

Since the app’s launch in 2022, hundreds of thousands of activities have been synched, along with tens of thousands of achievements earned and goals met by community members all around the world.

The pre-seed round was led by Bungalow Capital with participation from Overline, Fitt Insider, Shorewind Capital, OliveX, and The Gramercy Fund. Also joining are more than 30 angel investors.

WEB3 ROUNDUP

News on blockchain/web3:

Web3 technologies could be a game changer for the travel industry

Web3 will play a vital role in the creator economy

Web3 - A Transformative And Disruptive Multi-Trillion-Dollar Opportunity To Service Billions

China accounts for 84% of all blockchain patent applications, but there's a catch

JOB BOARD

Explore openings at our portfolio companies:

Featured Jobs:

Check out all of our portfolio companies at Social Leverage.

© 2017-2021 All Rights Reserved, Social Leverage LLC.

Affiliate Disclosure: Social Leverage Group, LLC ("SLG"), Social Leverage Capital Fund I, LP ("SLC"), Social Leverage Capital Fund II, LP ("SLCII"), Social Leverage Capital Fund III, LP ("SLCIII") and Social Leverage Capital Fund IV, LP ("SLCIV") are all distinct entities from Social Leverage, LLC ("SL"). Social Leverage is not a registered investment advisor. SLC, SLCII, SLCIII, SLCIV, SLG and SL have used the logo and branding of Social Leverage with the permission of Social Leverage Group, LLC.