- Social Leverage Weekly

- Posts

- Cash Rules, Playing the Long Game, the Economic Impact of AI, and Sleeping like a Baby

Cash Rules, Playing the Long Game, the Economic Impact of AI, and Sleeping like a Baby

Social Leverage Letter | Issue #82

Get smarter faster with our curated list of thought-provoking content for founders and investors:

3 articles, 2 podcasts, and 1 video.

Was this email forwarded to you? Sign up here.

READING

This article from Social Leverage portfolio company Secfi (Fund III) discusses the ongoing banking crisis and covers the purchase of Credit Suisse by UBS. Learn how banks make money through lending and how rising interest rates have caused stress in the banking system. Discover how the phenomenon of a "run on the bank" can lead to a crisis. The solution to restoring confidence in the system is thorough government intervention, which is happening in various forms around the world.

There are numerous benefits that come along with long-term thinking, a strategy adopted by successful entrepreneurs such as Jeff Bezos, Elon Musk, and Warren Buffet. Long-term thinking gives an "arbitrage" advantage, helps make better decisions, and leverages the power of compounding. The article also highlights the hazards of short-term thinking and recommends following the 5-Hour Rule to make long-term thinking a habit.

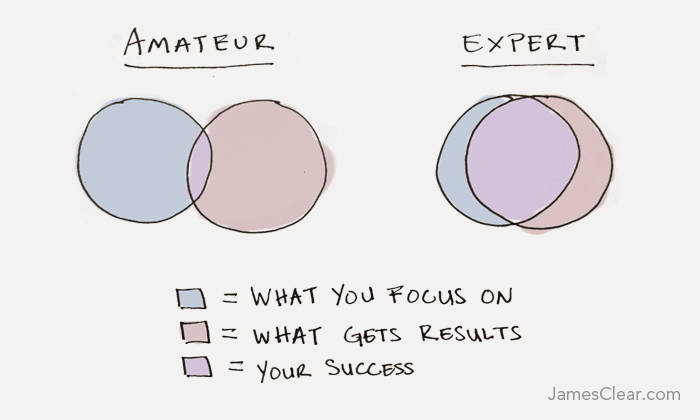

Selective attention, or the ability to focus on what matters and ignore distractions, is a key factor in expertise. For example, Peyton Manning's ability to quickly assess a defense and make snap decisions based on years of experience. And it highlights the importance of consistent practice and measurement in developing expertise, rather than relying on quick fixes or hacks.

LISTENING

II. Avi Goldfarb - The Economic Impact of AI

WATCHING

JOB BOARD

Explore openings at our portfolio companies:

Featured Job:

© 2017-2023 All Rights Reserved, Social Leverage LLC.

Affiliate Disclosure: Social Leverage Group, LLC ("SLG"), Social Leverage Capital Fund I, LP ("SLC"), Social Leverage Capital Fund II, LP ("SLCII"), Social Leverage Capital Fund III, LP ("SLCIII") and Social Leverage Capital Fund IV, LP ("SLCIV") are all distinct entities from Social Leverage, LLC ("SL"). Social Leverage is not a registered investment advisor. SLC, SLCII, SLCIII, SLCIV, SLG and SL have used the logo and branding of Social Leverage with the permission of Social Leverage Group, LLC.