- Social Leverage Weekly

- Posts

- The Bears Have it Wrong, More Fundraising Pain, Improving Innovation, and The Next Disney is in the Metaverse

The Bears Have it Wrong, More Fundraising Pain, Improving Innovation, and The Next Disney is in the Metaverse

Social Leverage Letter | Issue #73

Get smarter faster with our curated list of thought-provoking content for founders and investors:

3 articles, 2 podcasts, and 1 video.

Was this email forwarded to you? Sign up here.

READING

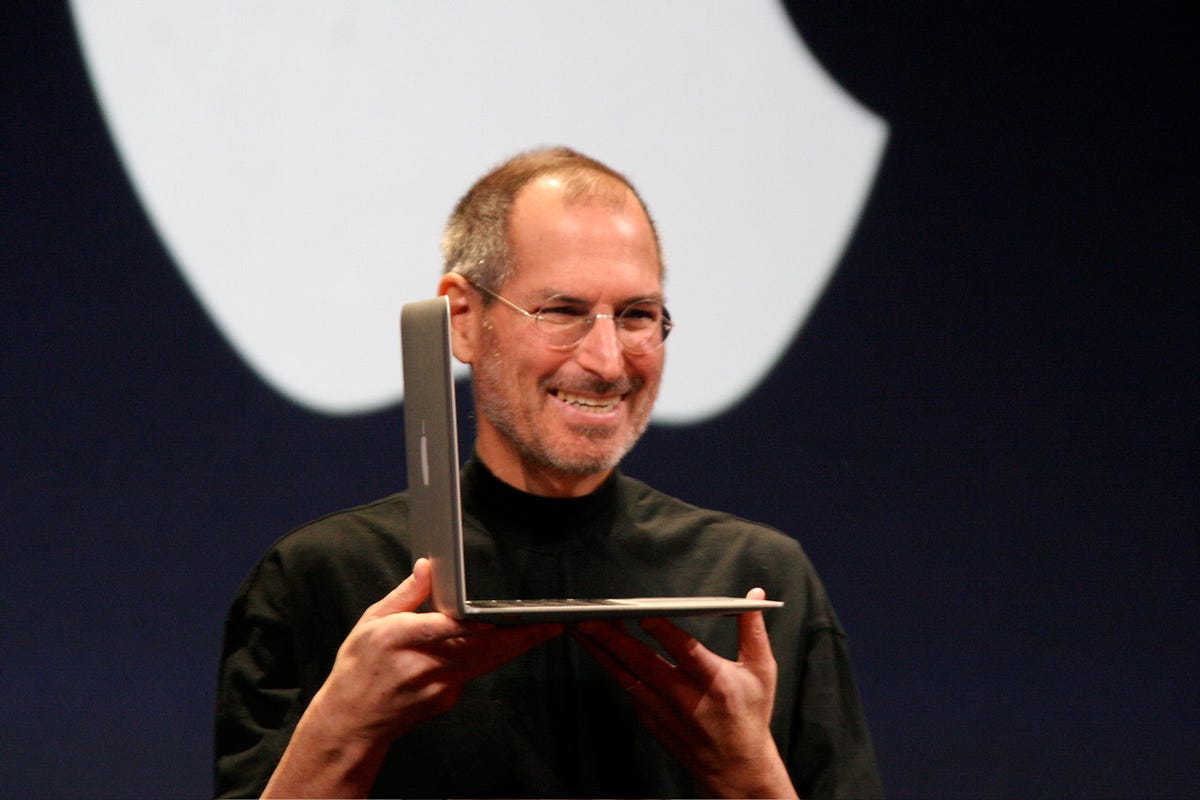

Our GP Howard Lindzon sat down with Business Insider to discuss investing strategies in a higher interest rate environment and shaky economy. Pessimism is already priced into the markets and there are still opportunities to make money. He believes the US will enter a recession in 2023, which is a contrarian reason to be bullish.

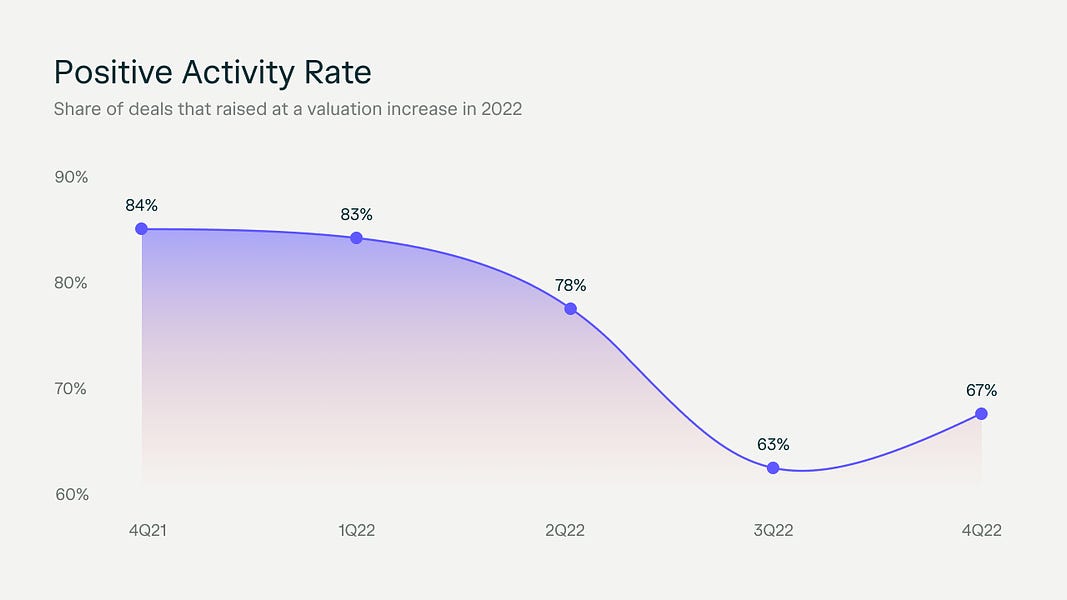

AngelList and Silicon Valley Bank's annual report on the state of early-stage startups and venture capital shows Series B valuations fell 50% from the first quarter of 2022 to the fourth quarter, with a smaller percentage of early-stage startups raising new money and more of them raising down rounds than in previous quarters. Despite this, venture capital firms still have a record $289B of dry powder to deploy. However, this year is expected to be a tough one for startups, as the valuation crunch continues to flow down to early-stage startups.

Research shows setting ambitious goals, often seen as the key to success, can actually be an obstacle to innovation and sap motivation. Research by Nobel Laureates and other innovators suggests pursuing curiosity and embracing serendipity can be more effective than solely focusing on goals.

LISTENING

WATCHING

JOB BOARD

Explore openings at our portfolio companies:

Featured Job:

© 2017-2023 All Rights Reserved, Social Leverage LLC.

Affiliate Disclosure: Social Leverage Group, LLC ("SLG"), Social Leverage Capital Fund I, LP ("SLC"), Social Leverage Capital Fund II, LP ("SLCII"), Social Leverage Capital Fund III, LP ("SLCIII") and Social Leverage Capital Fund IV, LP ("SLCIV") are all distinct entities from Social Leverage, LLC ("SL"). Social Leverage is not a registered investment advisor. SLC, SLCII, SLCIII, SLCIV, SLG and SL have used the logo and branding of Social Leverage with the permission of Social Leverage Group, LLC.